Wealth Management & Investing

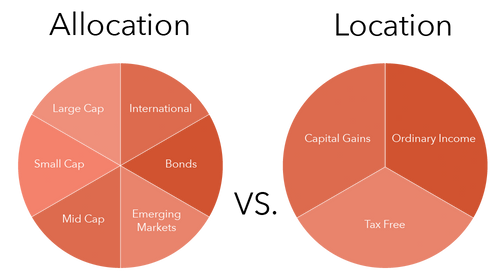

Our wealth management and investing services at Connect Tax and Wealth Management are undertaken with taxes in mind. In other words, our strategy is not just about allocating your investments between large cap, mid cap, small cap, bonds, or international or emerging markets, it’s about true diversification through locating your investments in assets that have different tax treatment in the first place. For instance, some investments create capital gains taxes, some are taxed as ordinary income (like your traditional 401(k) plans), and some are tax-free, like Roth accounts and most life insurance.

Asset Location Refers to Optimizing to Lower Your Tax Liability

Ask yourself these questions:

- Are my taxes considered as a fundamental part of my investment strategy?

- Do I have a plan in place to address the ordinary income taxes I will owe in retirement

- Are my investments hedged against stock market volatility?

- Is there too much risk in my portfolio based on my age and risk tolerance?

- Do I feel confident that I won’t run out of money in retirement?

Our Services

At Connect Tax and Wealth Management, we seek to provide each client with a comprehensive approach that allows you to simplify your life and make one phone call to manage almost everything related to your finances. Here are just some of the services we may provide as part of your custom financial and tax plan. Be sure to reach out to us for a complimentary conversation to discuss your life and financial goals and how we might help you reach them.